“When people ask me now what BRAC stands for, I like to think that we stand for an idea — an idea of a world where everyone has an equal opportunity to realise their potential”.

Sir Fazel Hasan Abed KCMG

Founder, BRAC

BRAC Myanmar

BRAC has two separate legally registered entities in Myanmar. BRAC Myanmar – BRAC’s non-governmental (NGO) entity started operating in 2013. At present BRAC Myanmar has programmes related to Agriculture, Food Security and Livelihood, Disaster Reduction and Resilience Building, and Financial Inclusion.

BRAC Myanmar Microfinance

Company Limited (BMMCL) BRAC Myanmar Microfinance Company Limited (BMMCL) was launched in 2013. Our mission is to provide a range of financial services responsibly to people at the bottom of the pyramid. We particularly focus on women living in poverty in rural and hard-to-reach areas, to create self employment opportunities, build financial resilience, and harness women’s entrepreneurial spirit by empowering them economically.

The Financial Inclusion Project gives financial literacy training to people in conflict-affected areas, people with disabilities, communities displaced by conflict and migrant women in peri-urban areas in Kayin. Our Agriculture, Food Security and Livelihoods Project aims to increase the availability and accessibility of freshwater aquaculture products by small-scale fish farmers. This project provides nutritious and affordable food and income for the poor and vulnerable households, giving support in Southern Shan, Sagaing and Mandalay.

BMMCL at a glance

- 144,535 borrowers, 96% of them women.

- 85 branches in 8 regions (Shan, Mandalay, Sagaing, Nay Pyi Taw, Bago, Yangon, Kayin, and Mon)

- 47% outreach to people living in poverty

- 54% outreach to people living in rural areas.

- USD 174 million disbursed in loans in Myanmar since 2014.

BMMCL’s products and services

Our core products include a groupbased microloan provided exclusively to women, small enterprise loans for entrepreneurs seeking to expand their businesses, and microenterprise loans designed exclusively for women. We also provide credit to smallholder farmers and have an inclusive financing product for persons with disabilities. Since 2020, we have been providing voluntary savings services to our clients. During the COVID-19 pandemic, we introduced refinancing of loans for people who needed additional capital to restart their businesses. We also suspended loans as needed and provide interest waiver for the convenience of our clients.

BMMCL’s social performance

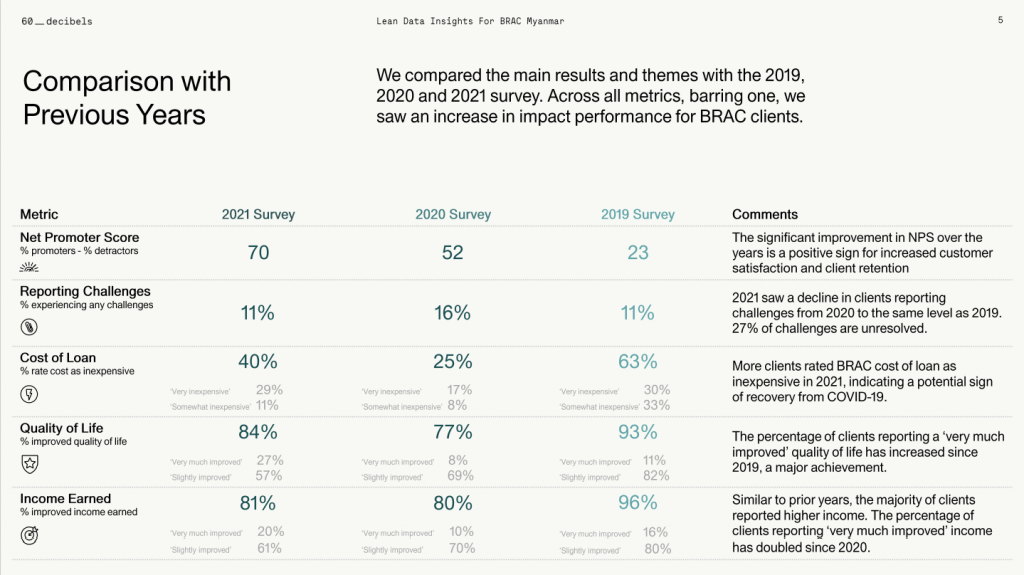

At BRAC, we believe that listening and learning directly from the people we are serving is the only way that we can achieve lasting impact. Since 2019, we have conducted yearly impact surveys measuring the five social outcome focus areas of BRAC International Microfinance: quality of life, financial resilience, women’s economic empowerment, self-employment and livelihood opportunities, and household welfare. In 2021, we conducted our third impact survey in partnership with 60 Decibels using Lean DataSM methodology. This annual exercise complements our Social Performance Management and Client Protection initiatives and guides us in setting targets and strategies to reach more people living in poverty and achieve long-term impact at scale. All respondents surveyed were women.

Highlights from 2021 Lean DataSM Impact Survey

- 84% of clients said their quality of life had improved after engaging with BRAC

- 81% of clients earned more after engaging with BRAC

- 67% of clients planned their finances better after engaging with BRAC

- 63% of clients saved more after engaging with BRAC

- 53% of clients contributed more to important household decisions after engaging with BRAC

BRAC Myanmar is grateful to the contribution of our investors and donors: FMO Entrepreneurial Development Bank, The US Development Finance Corporation (DFC), Grameen Credit Agricole Microfinance Foundation, Whole Planet Foundation, Livelihood and Food Security Fund (LIFT), YOMA Bank, AGD Bank, UAB Bank, UNCDF, The World Bank, World Fish, AAR Japan, UK AID, 60 Decibels, SPTF and Ongo Mobile banking.

”Myanmar microfinance clients are experiencing a higher need than ever due to the severe interruption of financial services, since the start of the pandemic. Collective effort from microfinance service providers, investors, donors and of course from the regulator is crucial to enable people living in poverty through the financial inclusion journey”

– Md Sazaduzzaman,

Managing Director of BRAC Myanmar.

About BRAC and BRAC Microfinance

BRAC was founded in Bangladesh in 1972 by Sir Fazle Hasan Abed. Today, BRAC partners with over 100 million people living with inequality and poverty globally to create sustainable opportunities to realise potential. BRAC’s community-led, holistic approach is reflected in its unique integrated development model, which brings together social development, social enterprises and humanitarian response for lasting,

systemic change. BRAC is born and proven in the south and has become a world leader in developing and implementing cost-effective, evidence-based programmes at scale, with a particular focus on communities in marginalised, extremely poor or post-disaster settings across Asia and Africa.

BRAC first expanded its microfinance operations internationally in 2002 and now operates in six countries outside of Bangladesh – Myanmar, Tanzania, Uganda, Rwanda, Sierra Leone and Liberia. Together, these six entities serve nearly 700,000 clients, 96% of whom are women. This year BRAC is celebrating its 50th anniversary, a significant milestone. BRAC Myanmar celebrated with over 600 staff at Ngwe Saung, Myanmar in June. The event focused on the internal staff engagement to promote cohesion, inspire the staff and emphasize in our staff our BRAC’s mission and values.

Khin Moe Win is a mother who lives with her five-year-old son, Aung Paing, in Dala township in Yangon. Khin has a wig business that she and her husband run together. She also makes handmade products such as bookbinding and handmade cards.

Khin Moe Win is a person with disability, and she never let’s anything or anyone discourage her. Her biggest hope is that her son will be educated and capable of earning for himself one day.

“There is nothing you can do without perseverance. You have to make a real effort to make it happen but also be patient” – Khin Moe Win.