On 29th March 2020, the Government of the Union of Myanmar directed the meeting decision of 2/2020 by the Committee for Remedying Economic Effects of COVID-19 stating that it will support the local businesses and SMEs to recover and be resilient from the COVID-19 impacts through the funding of a COVID-19 loan.

In supporting businesses, it will prioritize the CMP (Cut, Made, Package) business, hotels and tourism industry, and most SMEs to help with a total of 100 billion kyats COVID-19 funds. The loan interest is only 1% for a one-year duration, and the applicants had to submit their applications by 9th April 2020. Throughout the announcement, a total of 1,600 applications were submitted according to the statement from UMFCCI.

When the first and the second lists of the businesses which received the loans were announced on 8th April and 28 businesses which had applied for the loan, there were some complaints.

The first problem was the huge differences between the amount of cash which the businesses applied for and the amount which the businesses received as the loan.

Ye’ Myint Maung, General Secretary of Myanmar Food Processors and Exporters Association, confirmed such kinds of problems in his interview with The Irrawaddy news.

“We faced similar problems, and some businesses, for example, applied to get around 3,000 lakhs Kyats. However, they received 30 lakhs in total as the loan, which might lead to some businesses, who were already permitted to get the loans, cancelled their applications and rather chose not to receive anything than the very few amounts of the loans”.

The Apex International Company was one of the companies which rejected their applications. In an announcement made on 20th April, the company explained that it applied for a loan of 3,000 lakhs Kyats and the company received around 65 lakhs – which led the company to cancel their applications and decide not to take it which has been approved.

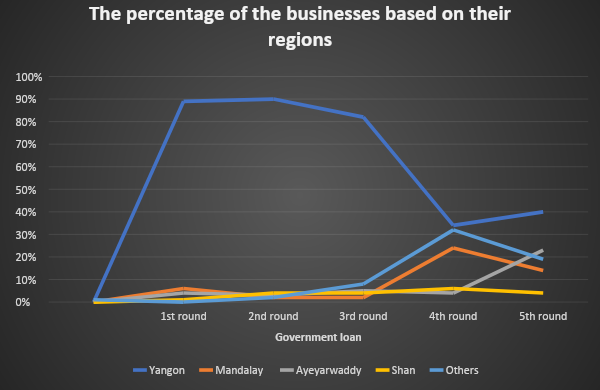

The second issue was that many businesses in Mandalay and other regions except for Yangon, commented the Committee had favored the Yangon based businesses than other regional businesses in considering, deciding and permitting the Government loans. Their comment was statistically true when Yangon-based businesses constituted almost 90% in the first round and second round, according to our analysis, have conducted the Government loan lists and analyzed the list of companies and their businesses into two main categories

(1) the location of the businesses

(2) the types of the businesses

The information used for the data analysis was updated before 13th June 2020, and we have examined a total of 1,016 businesses, their locations and types of the businesses during the five rounds of the government loan lists in this analysis. We will also conduct another survey of ‘the effectiveness of the Government COVID-19 loans on industries’ in next issue.

The Locations of the Business and the Percentage of Loans That Has Received

We distinguished the regions of the business mainly into five – Yangon and Mandalay (the major cities for businesses and SMEs), Shan and Ayeyarwady (the major cities where various travels and tours, hotels are existing), and the other regions – which is all the regions of Myanmar expect the aforementioned states and regions.

- The first and second rounds of businesses which were selected to receive the Government loans were announced on 9th April and 28th April respectively; and, a total of 85 businesses were included in the first round, and 113 businesses in the second. The important facts to consider is that although the businesses in the first and second round of the lists are divided into two types: (a) businesses permitted to get over 1,000 lakhs of loans; and (b) businesses permitted to get under 1,000 lakhs. Moreover, the exact amounts of total loans planned for the first and second round were not stated in the announcement of the Committee, some estimated that the 85 businesses received a total 6 billion Kyats, but this cannot be confirmed yet. However, since the third round of announcement, the Committee has stated the exact amount of loans planned for each of the rounds: 2.3266 billion Kyats for 111 businesses in the third round, 15.079 billion Kyats for 417 businesses, and 8.7335 billion Kyats for 290 businesses.

- In the first round, 13 out of 85 businesses, which are all Yangon based businesses, were permitted to get over 1,000 lakhs. The 89% of Yangon based business included in the first round in total of 85; while only 6% from Mandalay, 4% from Ayeyarwady and 1% from Shan states.

- In the second round of 113 businesses, 7 businesses were considered to get over 1,000 lakhs of the loans, whereas 6 businesses were from Yangon, except a Nyaung Shwe based Inle Princess Hotel. Some businesses chastised the loan committee for considering Inle Princess Hotel, owned by the Ministry of Hotels and Tourism, as a priority in considering the loans. Yangon based businesses constituted 90% of the 113 businesses of the second round, businesses from Mandalay was reduced to 2% (less than 4% compared to the first round). However, Ayeyarwady, Shan and other regions have 3%, 4% and 2% respectively.

- A total of 111 businesses included in the third round of the loans announced on May 7; in which Yangon based organizations still constituted the majority, with the 82% of the total; during the time, the number of businesses from Mandalay and Shan remain low with 2% and 4% respectively while Ayeyarwady based businesses increased to 5% and other regions become 8% of the total loans.

- In the fourth round announced on May 25, a total of 417 businesses were permitted to get the loans. During this round, the numbers of Yangon based businesses decreased to 34%, but still, the highest percentage compared to other regions. In conjunction with the decrease of businesses in Yangon considered for the loans; other regions were increased in proportions – leading to 24% for Mandalay, 32% for other regions, 4% and 6% for Ayeyarwady and Shan state.

- On June 2, the committee announced that 290 businesses were considered to get the loans as the fifth round. Nevertheless, businesses in Yangon still hold the plurality of the numbers -leading with 40% of the total; while Mandalay became 14%, Ayeyarwady was increased to 23%, Shan State was still 4% and other regions constituted 19%.

We can conclude that, according to our descriptive analysis, the recipients of the government loans selected by the Committee are mainly Yangon based businesses. As shown by the information on the graph, businesses from Shan State, a region not only important for the Travels and Tourism but also many hotels and SMEs located, have only received very few percentages of the Government loans support till the fifth round, which might lead the businesses in the Shan States more facing the severe impacts of the COVID-19 consequences, especially when all the travels and tours have to be shut down. But UMFCCI did not publish the details of all the applicants’ information to the public.

Moreover, the second commercial city of Myanmar – businesses in Mandalay have only received almost half of the Government loans compared to the Yangon ones. These different percentages are required to be fairly distributed as much as possible since business not only in Yangon, but also all around the country are facing economic issues of COVID-19.

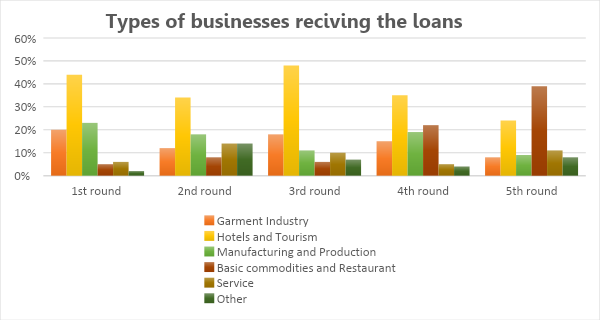

Businesses Types

The businesses are distinguished into six different sectors under our categories of (1) Garment industry, (2) Hotels and Tourism, (3) Manufacturing and Production sectors (4) Basic commodities and Restaurant, (5) Service sectors and (6) others. As described above, the sectors of CMP businesses, Hotel and Tourism, and SMEs, are prioritized and considered in permitting the Government loans. According to our analysis, the types of businesses up to 5th round of the business, Hotels and Tourism sectors have been considered the top priority and have received the plurality of the loans with an average of 35%. The sectors following after Tourism were the Garment Industry and Manufacturing and Production Industry where many SMEs and factors are included. But, the interesting point at the later rounds (especially for 4th and 5th round) of the Government loans is that the loans committee seemed to have considered the loans towards basic commodities and restaurants sectors most compared to the other sectors. Many restaurants and SMEs, except basic-commodities sectors, have been facing the most impacts of COVID-19 due to the lesser demands and lockdowns during COVID-19 periods and lower purchasing power of the public than normal. Moreover, during the fourth and fifth round of the loans, the new sectors such as Journalism and education sector (education centers) were considered as an eligibility for the loan.

How Much Is It Spent

A total of 100 billion MMK was planned to be used for loans, it was already 5th round by the time we analyzed this study and 1,016 businesses were included. Although the exact amount of loans was not stated for the first and second round as the other rounds of the loan, we, according to the different sources, estimated that a total of around 41.345 billion have been used as the loans. This means that over 41% of the Government loan plans were implemented.

Since, the needs of a business to be recovered can be changing with time, there will be a new and important sector needed to be considered and required to get a required loan. Receiving the right amount of cash within the right time is crucial for the recovery and resilience of a business and we, Myanmar Business Insider, hope all the business would get the enough amount of the loans they need and receive the loan amounts within the timeline they expected.