Any first year student of economics would be able to tell you the price of goods and services could only be determined by the forces of demand and supply and any effort to affect otherwise would ended up creating consumers’ and producers’ surpluses, which would eventually result in negative externalities.

Yet efforts across the world by different governments to somehow control the prices of consumer goods are uncontrollably persistent, from rich first world countries who exercise rent controls (EU) or control the property prices (Singapore), to developing countries to those in the badly managed countries category.

Price controls are not new. In fact, in the code of Hammurabi by the King of Babylon in 1800 BC included the set prices for the wages of craftsman and labourers some 3800+ years ago. Nowadays governments of various forms set controls by blunter blades of political pressure and haphazard response to inflationary pressures. Recent data from the World Bank showed that 89% of developing economies meddle with price of energy, 76% with price of food stuff, 13% with price of construction materials.

What mechanisms are there to control prices? The common ones included the price floors, where the minimum price that has to be paid to producers such as farmers and industries of essential national goods. Then, there were price caps aka price ceilings routinely set on indispensable consumer goods and services. We also come across techniques such as rent control in developed countries to provide affordable housing to the poor and the homeless. In mid 2019, Germany voted to freeze rent for 5 years. And price caps on a variety of goods and services exist in Spain, Holland and French. The current Biden administration even set controls on some drug prices in USA. At least half of the developed world has the minimum wages set into law, which itself is a form of price control.

Reasons for price controls are uncomplicated; the altruistic reasons remain to redistribute the economic burdens and wealth, to provide stability to the prices and the economy and potentially deflate the price of essential goods and services. This in turn would secure economic stability. Price caps aka ceilings help the poor afford necessities of life, while price floors prop up livelihoods of farmers. Keeping buffer stocks also stabilise volatile commodity prices.

Do they really work?

The obvious advantage especially on price controls on essential goods and services is to prevent traders and producers from price gouging. The secondary objective may be to prevent monopolistic behaviour among suppliers. The setting of minimum wages ensures at least a basic standard of living for wage earners.

As of now (August 2024) in Myanmar, the government has imposed price ceilings over foreign currencies, gold, rice, edible oil, bus fare, etc., with varying degree of initial success. Plus minimum wage law has already been in place since 2015.

Let us look at experiences of some developing countries.

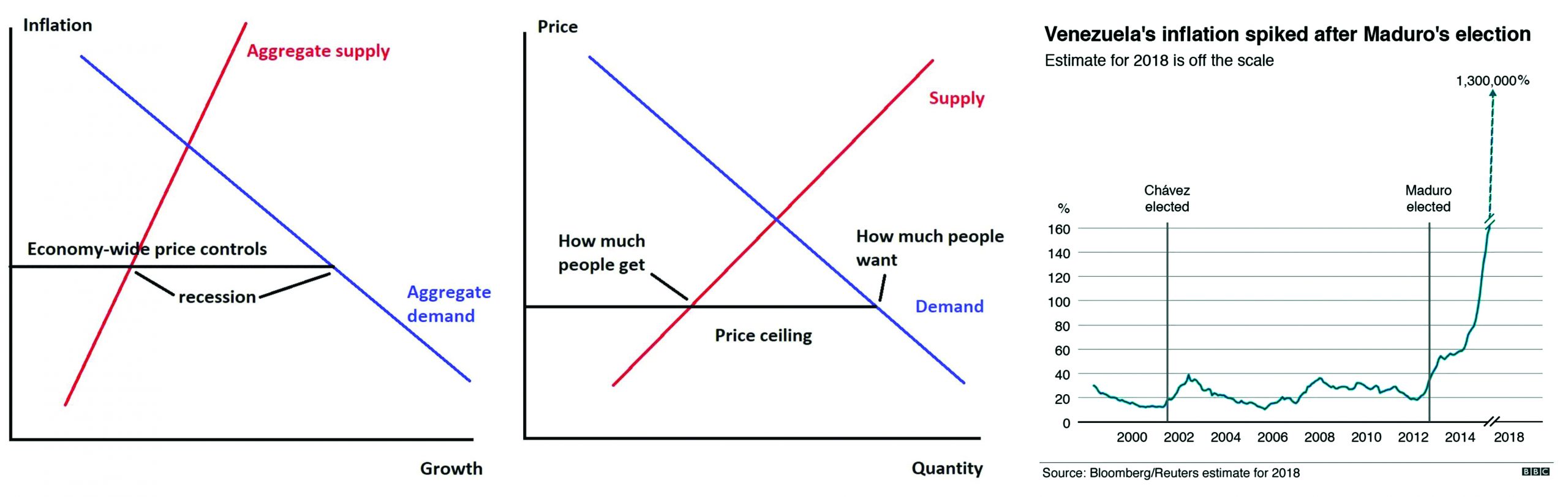

Venezuela even has its parliament decree a fair price and cost law, to adopt the concept of price controls into law. They even made inflation illegal, i.e., it is illegal for traders and procedures to increase the price of goods without approval from government.

Yet years after its adoption price controls, Venezuela now has the world’s highest inflation rate. There are reduced availability of staple goods, with supermarkets having more and more empty shelves.

People have difficulties in finding cooking oil, chicken, powdered mil, cheese, sugar and meat. Government using its regular inflows of foreign currencies through the sale of crude from its vast oil reserves, imported by spending $7.5 billion on food imports to alleviate the shortage. But due to incompetence and corruption within the administration, vast shipment of food rotted before reaching the shops and public.

The famous Albert Einstein define insanity as to do the same thing over and over agin and expecting a different result.

Another South American country did the same thing. Argentina fixed prices of nearly 1,500 products as of last October, to control its on food prices. Now the country is facing an inflation rate nearly as high as that of Venezuela. Controls did assure a kind of stability in the country, preventing riots and chaos due to hyper inflation. But they came at a cost; Argentina has no economic growth since 2008, wages increases has fallen steadily behind less than inflation, making people lose their purchasing power and become steadily poorer.

The bad and the ugly

However well intentioned price controls are, they cannot overcome the economic forces of demand and supply in the long run. Price caps will cause the creation of excess demand and setting minimum prices will produce excess supplies.

Producers are better off at not producing rather than selling at government controlled prices, that would cause them to make losses. If they are forced to sell at these price ceilings, they would some how produce a lower quality version. Due to sub normal profits or losses, ceilings lead to underinvestment, hoarding and black markets.

Once started, these controlled prices are hard to remove. Economic theory suggests that it is best to implement ceilings when market prices are low, yet politics is such that elected officials are always slow to react and started with these control measures when they are faced with prospects of hyber inflation. It is better not have the controls in the first place, if the timing could not be right. But it is easier said than done in public affairs.

Prices are used to allocate scarce resources efficiently. Price controls distort thesis signals, leading to inefficient allocation, resulting in unwanted producer or consumer surpluses. They can even cause severe shortages if prices are set near or below producers’ costs, which discourages production. They cause disruption in the market, losses for producers and a noticeable change in quality. The final long term impacts would be shortages of those products under control, rationing, deterioration of quality, illegal markets, unofficial channels.

What about us

Foreign currency: The controlled exchange rates were put in place post 2021. Since then the spread between the CBM rates and the reality has gone wider and wider. The current CBM rate hovers around 3,000 Kyats per $ whereas the actual rates are now above 6,000 Kyats per $ (100 differential). There is simply no one transacting at the former controlled rate. CBM said small change is available for people going abroad but the truth is there is no such bank offering that facility at this point of time. If you need FX, be prepare to look high and low for black market traders and offer them whatever they asked. Feel free to report them to authorities if they did ask for an exorbitantly higher swap value. Foreign currencies are in short supply. Even some government department has to resort to outside purchases as the wait list and duration become unbearable. Even though most of the underground traders have been put into prisons, house arrests or been on the run, the situation is heading south, without an endless and sufficient supply being released into the market by the CBM. Even if it is achievable, the administrative process itself will enrich only the insider few and some financial institutions. The controls are going to get harder and harder to administer without further damage to the confidence on the recoverability of Myanmar economy.

Gold: Gold entrepreneurs have gone underground for the bulk of trading. The actual gold shops are only selling a minuscule amount of pure gold at controlled prices when the price controls started. Then the arrests came. Then promises by them to stay within the price limits. Now, they are selling at price ceiling set, but added on an enormous amount of handcraft service fees so that the final transacted price equate to the market price of gold.

At the time of writing, the government/Gold Association set price is at 47 Lakhs per tickel while the market offer is at 75 Lakhs per tickel (60+ % differential). In essence, consumers paid the market price (set price plus the handcraft service fees added). Only gold shops benefited by cheating honest customers who sell gold by offering them only controlled rates. Again, the gold sellers who want to receive the market price has to hunt around for who knows who of gold shops and deal with them in secret. So much for the success of price control operation on this gold. Probably the only beneficiaries are gold shop owners who acted as if they have been given license to cheat consumers and a few good men from Special Investigation branch who are at liberty to blackmail the shop owners in return.