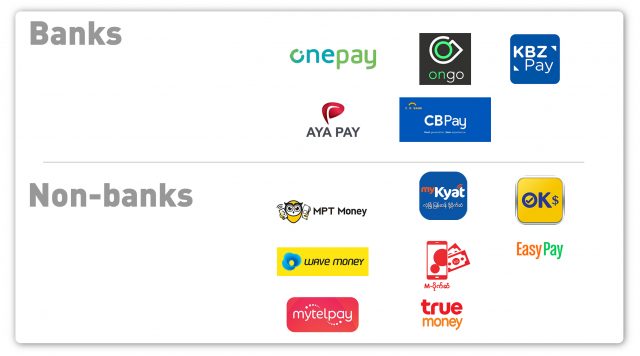

There are about 24 million mobile wallet accounts in Myanmar. These accounts come from non-bank wallet providers, as well as, banks. The popular non-banks Mobile Financial Services (MFs) providers are Wave Money, OK$, M-Pitesan, My Money and MPT Money. A third of 35 or so licensed banks also have wallets or are in the process of applying for wallets licenses. These wallet accounts are typically divided into two tiers: Level 1 and Level 2. Level 1 is given without ID verification and Level 2 is for those with their ID already verified.

As recent as last month, there has been an uproar, at least in the Facebook, over CBM’s (Central Bank of Myanmar) plan to require conversion of all Level 1 wallet accounts to Level 2, within a period of three months. Given that Level 1 accounts about to 18 million, it seems to be an enormous tasks for everyone, to complete before the year end.

A lot of people ended up interpreting the signals from CBM negatively; some thought it has something to do with terrorism funding to NNCP terrorist groups, some speculated the government just needed the money from dormant accounts, some created the rumours that CBM is creating revenues for government through confiscation of Level 1 accounts. Nothing can be further from the truth.

FATF Blacklist

CBM has been trying hard to address the AML (Anti Money Laundering)/ CFT (Combating Financing of Terrorism) issues and accusations internally to address the findings and recommendations of FATF (Financial Action Task Force) for quite sometime. During the third week of October, MI has learnt that Myanmar has been moved to the blacklist by the FATF from the previous brown list. There was some panic in the social media, some speculators exploiting on the news to push up the $ exchange rate to 6,000 Kyats, if truth be told, albeit no buyers. Once most people realise the lack of impact of this blacklisting on domestic economy, the $ fall back to the original pre-news price around 2,500 Kyats.

Most people have now realised that Myanmar was under black list for all years under President Thein Sein administration, yet the country’s best days of economic growth and prosperity happened under his watch. The country was moved up to brown list around 2016 and now it is back to the original blacklist. The likely impact of this would be on Myanmar nationals and companies having overseas bank accounts and NNCP terrorists groups and their donation collectors, as the banks overseas would now have to conduct more thorough due diligence and KYC (Know Your Customer) checks, prior to accounts opening or transfer transactions.

Moving Up to Level 2

Forced changeover of all wallet accounts into Level 2 is also in line with eKYC and eID requirements for all digital money accounts. During the implementation period of mobile wallets nearly ten years ago, the government and the advising international organisations’ primary objective was financial inclusion. Both wanted the wallets and easier transfers to be available up to the most underprivileged. In order to encourage widespread use of mobile wallets, the account opening requirements and KYC requirements are not set as first priorities. As long as you have a phone number, here comes the digital wallet for you.

As time passes, both CBM and the government realised this created a lot of potential fraud opportunities. Rural population of Myanmar are also easily gullible, so the number of fraud cases kept on increasing every year. Hence, the requirement for KYC now.

The process to more up to Level 2 is relatively simple: the customer has to submit a copy of their ID card, front and back, digitally or at the offices of the mobile payment companies/wallet providers. CBM expects the process to be completed within five months. Based on the stratification, the top wallet KBZ Pay already has 10 million accounts, out of the whole country Level 1 total of 18 million, followed by Wave Money and OK$. CBM is confident that 95% of Level 1 accounts would be successfully upgraded to Level 2 during this period.

One of the concerns expressed by the general public was what would happen to the accounts not converted to Level 2. CBM estimate of 95% conversion translates into nearly one million dormant accounts, that would not be converted. Obviously, one could reason it out that, if the account holder does not care about his own money, who else would!

These leftovers are not for MFS licensed holders either. All non-bank wallet providers have to keep security deposits in a trust account with a partner bank, an equivalent amount of the sum of total wallet accounts balances. The interest earned on these accounts also have to be used for industry development purposes only (such as conversion fo Level 1 to Level 2). From the customer perspective, however, these accounts are non interest bearing. Even if $10 is left in each account, the value of the dormant accounts would be nearly $10 million and the sum of all wallets balances would have reached $240 million.

The Future of Digital Wallets

This ID upload requirement is just the first of many verification steps for KYC. For bank owned MFS (Mobile Financial Services) or mobile wallet operators, it is relatively simple, as they are linked to their respective bank accounts. The final consolidation would be all wallet owners be matched with their owned registered SIM cards and their ICs, in coordination with the database from Ministry of Transport and Telecommunications (in charge of telephone SIM card registrations) and Ministry of Immigration (in charge of IC database). Only there would there be total integration of services through linkage to the correct beneficial owner of a particular wallet account, that corresponds with his ID and mobile number.

As far back as 2018, CBM has boasted that mobile wallet integration, i.e., the ability to transfer from one wallet provider account to another, just like banks, would take place within 12 months. Yet, four years down the road, the integration is still a WIP. CBM has further promised that it would be completed before the end of 2023, during a recent meeting.

Regardless of how onerous it might be, this KYC improvement is just another bitter pill to swallow, not only for CBM and the government, but also for compliance with BIS (Bank of International Settlement) requirement and ASEAN wallet inter-operatability obligations, which requires full KYC on all wallet accounts prior to allowing transactions across borders.

The wallets are here to stay in the country. People have gotten used so much to the ease of operability of the wallets that, we cannot fathom how this simple KYC step would put a wall to the continued popularity of the wallets. In 2021, there were around 700 million wallet transactions amounting to ~$21 billion, at current exchange rates. This total is nearly one third of Myanmar GDP, highlighting the prevalence of transfer payments among citizens and probably continued domination of grey economy in our daily lives. Based on these two statistics, the average wallet transaction size amounted to $30 in 2021. The wallets cannot be subdued. Within the first nine months of 2022, the transaction number has reached 680 million with a value total of ~$18 billion. Both figures would surely surpass those of 2021 at the end of current calendar year.